Many companies face the problem that customers who already have several overdue and unpaid invoices place new orders. This can significantly increase their exposure and risks, worsen cash flow, or even cause significant damage to their financial situation.

These situations may occur when the amount of customer receivables is not monitored during sales, for example because the IT system supporting the sales processes is not capable of doing so. An important aspect is that different partners should be treated differently; providing a reliable, established partner with a larger credit limit, while allowing newer, little-known or considered risky customers a narrower limit.

The safest solution is if the outstanding limits can be defined for each customer, and their automatic monitoring and enforcement is already ensured during the sales process, for example in the server IT system.

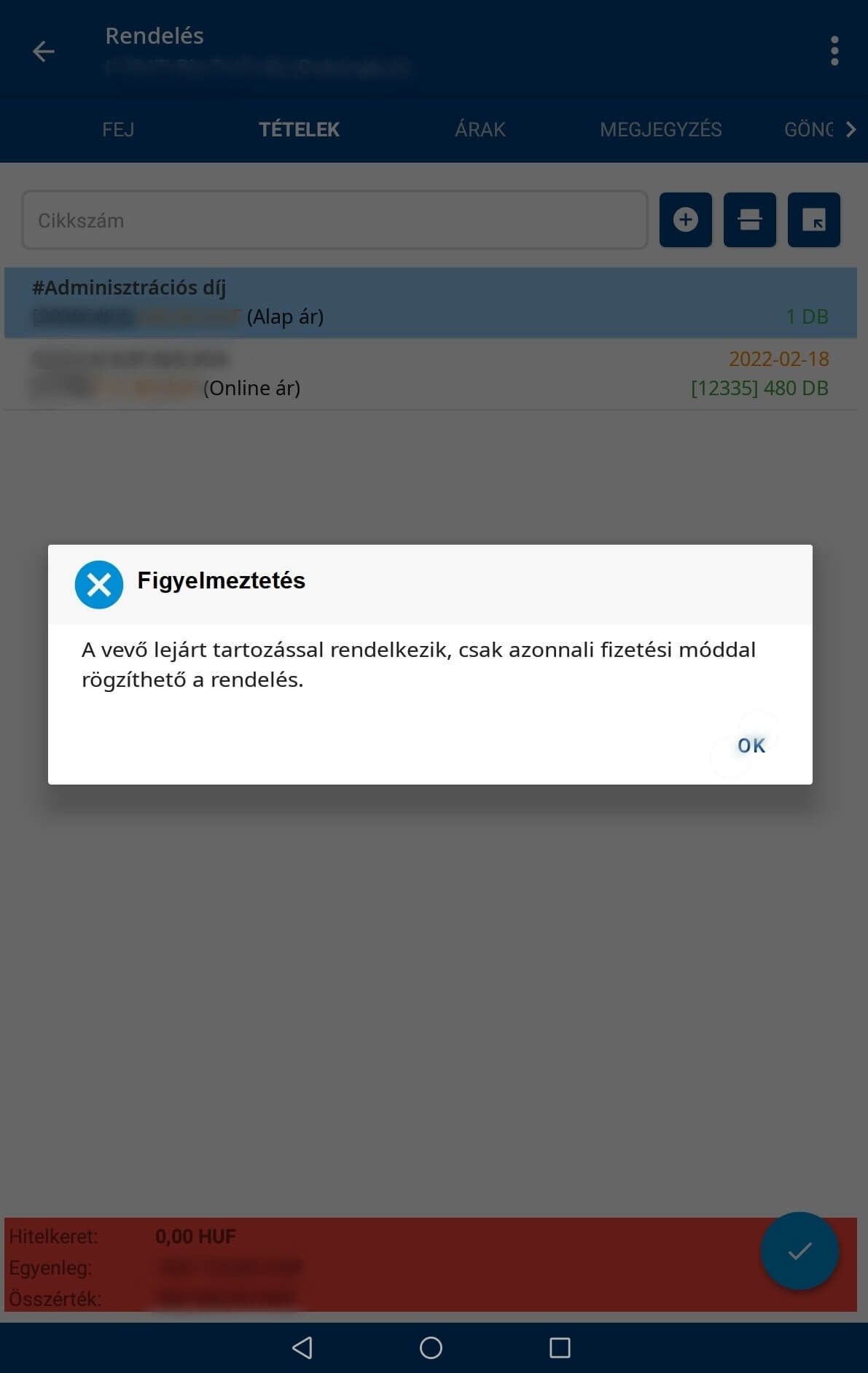

With the user-friendly solution of the FusionR Sales App, credit limit management easily becomes a part of daily work. For Partners, the maximum value limits can be entered in groups or individually. If the customer exceeds its limit when recording the new order, according to predefined and set regulations, FusionR Sales App warns the user placing the order and only allows immediate payment for the order or in stricter cases, it can block the sales process.

In the FusionR Sales App, the invoices belonging to the credit line and the overdue debts can be seen in an organized manner on the partners’ data sheet, which enables an overview of the customer’s financial situation, thereby supporting sales and marketing activities. Credit limit checking is easy to customize; priority customers can be handled individually, and if necessary – even subject to management approval – the credit limit check can be paused.

The primary task of FusionR Sales App’s components is the central, consolidated support, management and control of customer relations and sales and marketing activities. With its help, customer information can be collected, organized and stored, commercial and customer service processes can be carried out in a quality, planned and controllable manner. The customer database, which is technically uniform but manages customer segment-specifically differentiated data, can be managed together with customer interactions, offers, contracts, service orders, additional customer documents, invoices and payments, accounts receivable, and complaints.

The FusionR Sales App solution can be used as an integral part of the FusionR Sales product family, or independently – as a stand-alone solution or integrated into the systems of other suppliers. With the help of the integrated App, Calls, Portal and Net components of FusionR Sales, the „traditional” field representatives, telephone and online channels of the company’s commercial activity can be supported with an integrated IT solution.